Contrarian 500 Program

Objective

The program seeks capital appreciation that is uncorrelated with the S&P 500 Index, the Barclay CTA Index, the U.S. Government Bond Index, and major hedge fund indices. The program trades exchange-listed futures contracts, which are taxed at more favorable rates than equities or fixed income securities.

Strategy Highlights

Past performance is not necessarily indicative of future results.

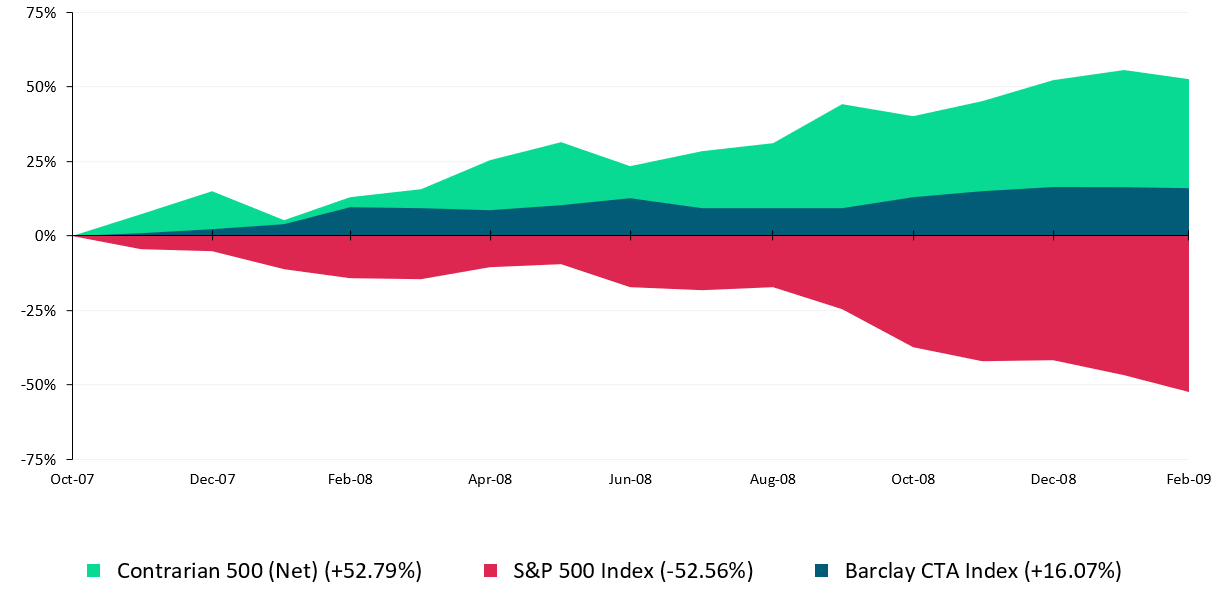

Bear Market Returns: 10/31/2007 – 2/28/2009

Investment Strategy

Investment Strategy History

Brad Paskewitz began developing futures forecasting models in 1987.

- Mr. Paskewitz established several trading desks and oversaw systematic trading teams that utilized techniques such as neural networks, statistical pattern recognition, genetic algorithms, and data visualizations.

- Leveraging his decades of research and trading experience, Mr. Paskewitz started his own firm and launched the Contrarian 500 program in December 2003 under the name of Paskewitz Asset Management, a registered Commodity Trading Advisor.

- The original design was based on three (3) contrarian models largely driven by pattern recognition.

- Our models leverage machine learning to adapt to new information and market conditions, providing investors the potential for a robust return over long term.

RETURNS

Growth of 10k

Annual Returns vs S&P 500

| Contrarian 500 (Net) | S&P 500 Index | Barclay CTA Index | |

|---|---|---|---|

| 2021 YTD | -0.83 | 5.77 | 2.10 |

| 2020 | 8.72 | 16.26 | 5.45 |

| 2019 | 2.48 | 28.88 | 5.17 |

| 2018 | -19.10 | -6.24 | -3.17 |

| 2017 | 4.66 | 19.42 | 0.70 |

| 2016 | 3.70 | 9.54 | -1.23 |

| 2015 | 12.68 | -0.73 | -1.50 |

| 2014 | 2.34 | 11.39 | 7.61 |

| 2013 | -6.09 | 29.60 | -1.42 |

| 2012 | 6.08 | 13.40 | -1.70 |

| 2011 | 8.01 | 0.00 | -3.09 |

| 2010 | -6.77 | 12.78 | 7.05 |

| 2009 | 3.02 | 23.45 | -0.10 |

| 2008 | 32.36 | -38.49 | 14.09 |

| 2007 | 39.19 | 3.53 | 7.64 |

| 2006 | 38.98 | 13.62 | 3.54 |

| 2005 | 14.06 | 3.00 | 1.71 |

| 2004 | 17.30 | 8.99 | 3.30 |

| 2003 | -0.14 | 5.08 | 3.43 |

| Contrarian 500 | S&P 500 | Barclay CTA | |

| Annualized Return | 8.26% | 7.93% | 2.76% |

Performance & Risk Statistics

| Contrarian 500 (Net) | S&P 500 Index | Barclay CTA Index | |

|---|---|---|---|

| Cumulative Return | 318.97% | 295.13% | 61.30% |

| Annualized Return | 8.57% | 8.21% | 2.78% |

| Average Monthly Return | 0.77% | 0.75% | 0.24% |

| Annualized Volatility | 14.31% | 14.36% | 5.26% |

| Sharpe Ratio | 0.59 | 0.57 | 0.51 |

| Sortino Ratio | 0.78 | 0.70 | 0.97 |

| Alpha (vs. S&P 500) | 7.82% | - | 2.44% |

| Beta (vs. S&P 500) | 0.08 | - | 0.03 |

| Correlation (vs. S&P 500) | 0.08 | - | 0.09 |

| Correlation (vs. Barclay CTA) | 0.04 | 0.09 | - |

| % of Positive Months | 61.24% | 65.55% | 53.59% |

| Maximum Drawdown | -26.41% | -52.56% | -9.91% |

Monthly Returns

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | YTD | S&P 500 | CTA * | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2021 | -0.84 | 2.47 | -2.41 | 5.92 | -0.83 | 5.77 | 2.10 | ||||||||

| 2020 | -2.99 | -8.35 | 8.19 | 2.74 | 1.15 | 0.87 | 4.58 | 2.99 | -1.54 | -4.29 | 2.87 | 3.26 | 8.72 | 16.26 | 5.45 |

| 2019 | 1.35 | -1.15 | 1.79 | -0.78 | -2.27 | 1.52 | 0.56 | -0.12 | -0.54 | -2.06 | 0.96 | 3.35 | 2.48 | 28.88 | 5.17 |

| 2018 | -2.49 | -2.83 | -4.17 | 2.94 | 1.49 | -0.89 | -0.03 | 1.02 | 0.74 | -14.07 | 3.54 | -4.93 | -19.10 | -6.24 | -3.17 |

| 2017 | 1.02 | -1.83 | 1.51 | 0.31 | 1.55 | 0.50 | -0.13 | 1.46 | 0.38 | -0.66 | 0.54 | -0.05 | 4.66 | 19.42 | 0.70 |

| 2016 | -6.79 | 2.13 | -1.00 | 1.92 | 0.50 | 3.64 | -0.36 | 1.88 | -3.10 | -0.18 | -0.24 | -0.55 | 3.70 | 9.54 | -1.23 |

| 2015 | 4.24 | 0.96 | 2.92 | 1.09 | 1.70 | 0.46 | 3.15 | -5.34 | 0.79 | -1.37 | -0.62 | 4.42 | 12.68 | -0.73 | -1.50 |

| 2014 | 0.16 | -1.71 | 2.61 | 4.02 | 0.35 | -0.22 | -0.47 | 0.12 | 2.07 | -2.20 | -1.77 | -0.44 | 2.34 | 11.39 | 7.61 |

| 2013 | -4.89 | 4.79 | -1.00 | 6.20 | -3.97 | -2.00 | -9.11 | -1.50 | -4.04 | 2.53 | 1.31 | 2.51 | -6.09 | 29.60 | -1.42 |

| 2012 | -2.91 | -1.54 | 2.83 | 3.06 | -4.36 | 4.14 | 1.80 | -0.20 | -0.52 | 1.52 | 0.74 | 1.70 | 6.08 | 13.40 | -1.70 |

| 2011 | 1.54 | 3.03 | -1.38 | -2.72 | 5.54 | 1.62 | -0.07 | -14.79 | 10.04 | -0.08 | 1.26 | 5.84 | 8.01 | 0.00 | -3.09 |

| 2010 | -2.02 | 4.47 | -12.18 | 3.34 | 2.13 | 0.00 | 10.13 | -0.28 | -7.45 | 2.64 | 0.55 | -6.32 | -6.77 | 12.78 | 7.05 |

| 2009 | 2.25 | -1.81 | -0.63 | 2.15 | 1.87 | 0.22 | -5.52 | 2.67 | -0.90 | 0.41 | 0.98 | 1.59 | 3.02 | 23.45 | -0.10 |

| 2008 | -8.41 | 7.34 | 2.35 | 8.54 | 4.66 | -6.12 | 4.20 | 1.93 | 9.99 | -2.71 | 3.49 | 4.88 | 32.36 | -38.49 | 14.09 |

| 2007 | 4.56 | -7.81 | -3.09 | -0.72 | 8.41 | 5.73 | -6.60 | 22.86 | 0.55 | -1.29 | 7.17 | 7.28 | 39.19 | 3.53 | 7.64 |

| 2006 | .038 | 2.09 | 4.85 | 8.59 | -3.95 | 1.82 | 2.84 | 3.08 | 5.29 | -1.98 | 9.92 | 1.28 | 38.98 | 13.62 | 3.54 |

| 2005 | 2.19 | 3.32 | -1.23 | 1.24 | 2.88 | 1.11 | -0.73 | 2.91 | 1.45 | -0.08 | -2.11 | 2.44 | 14.06 | 3.00 | 1.71 |

| 2004 | 0.61 | 2.87 | 2.66 | 3.54 | -1.75 | 2.82 | 0.76 | 2.63 | -0.53 | 4.54 | -4.09 | 2.34 | 17.30 | 8.99 | 3.30 |

| 2003 | - | - | - | - | - | - | - | - | - | - | - | -0.14 | -0.14 | 5.08 | 3.43 |

PERFORMANCE DISCLOSURE

The historical performance presented from December, 2003 to December 31, 2019 reflects actual performance results that have been adjusted on a pro-forma basis to reflect an annual 2% management fee and an incentive fee of 20%. The performance information presented for the period after January 1, 2020 has been adjusted to reflect the actual fees charged to the program being offered. The management fees range from 0% to 2% and performance fees range from 0% to 20%. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

DISCLAIMER

Past performance is not necessarily indicative of future results. The advisor’s trading program involves substantial risks and investments can be made on the basis of a trading advisory agreement. The risk of loss in trading commodities and futures can be substantial. PURSUANT TO AN EXEMPTION FROM THE COMMODITY FUTURES TRADING COMMISSION IN CONNECTION WITH ACCOUNTS OF QUALIFIED ELIGIBLE PERSONS, THIS ACCOUNT DOCUMENT OR BROCHURE OF THE TRADING ADVISOR IS NOT REQUIRED TO BE, AND HAS NOT BEEN, FILED WITH THE COMMISSION. THE COMMODITY FUTURES TRADING COMMISSION DOES NOT PASS UPON THE MERITS OF PARTICIPATING IN A TRADING PROGRAM OR UPON THE ADEQUACY OR ACCURACY OF THE COMMODITY TRADING ADVISORS DISCLOSURE INFORMATION. CONSEQUENTLY, THE COMMODITY FUTURES TRADING COMMISSION HAS NOT REVIEWED OR APPROVED THIS TRADING PROGRAM OR THIS ACCOUNT.

Prior to May 2020, Strategic Capital Advisors, LLC was called Paskewitz Asset Management LLC.