THE STRATEGIC PERSPECTIVE – WEEK OF FEB 19, 2021

Macro Trends:

In this week’s edition Sune Hojgaard Sorensen, our Director of Macro Research, takes a look at the demographic trends in the US, and how they are set to change the political landscape with far-reaching implications including the potential for outperformance in the commodity space in the years ahead.

US politics from 30,000FT & potential investment implications…

The recent US presidential election got a lot of attention. It may come to be a seen as a point of departure, but the dynamics of the 2024 election may prove more consequential in terms of actual policy changes.

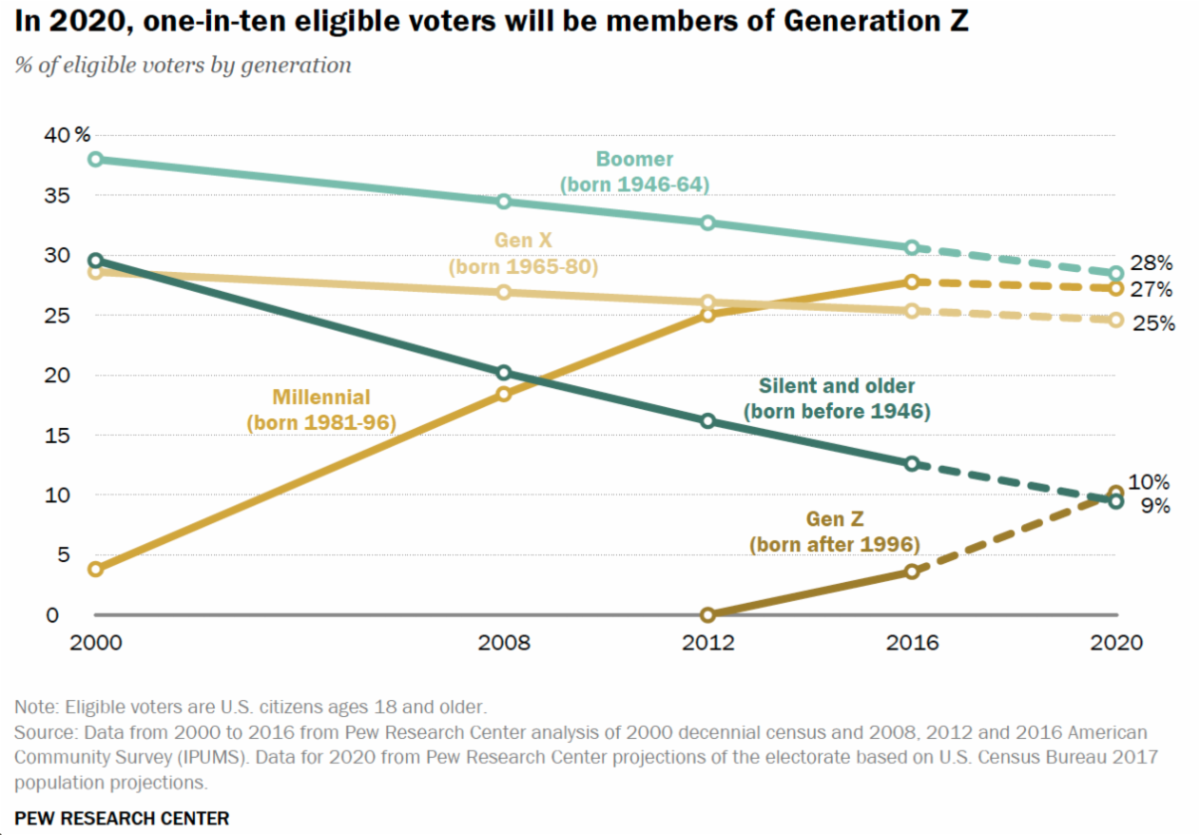

In 2020, the Millennial and Gen Z generations numerically match the Boomer and Silent Generation in the electorate and this trend will obviously only continue to tilt more and more in their favor.

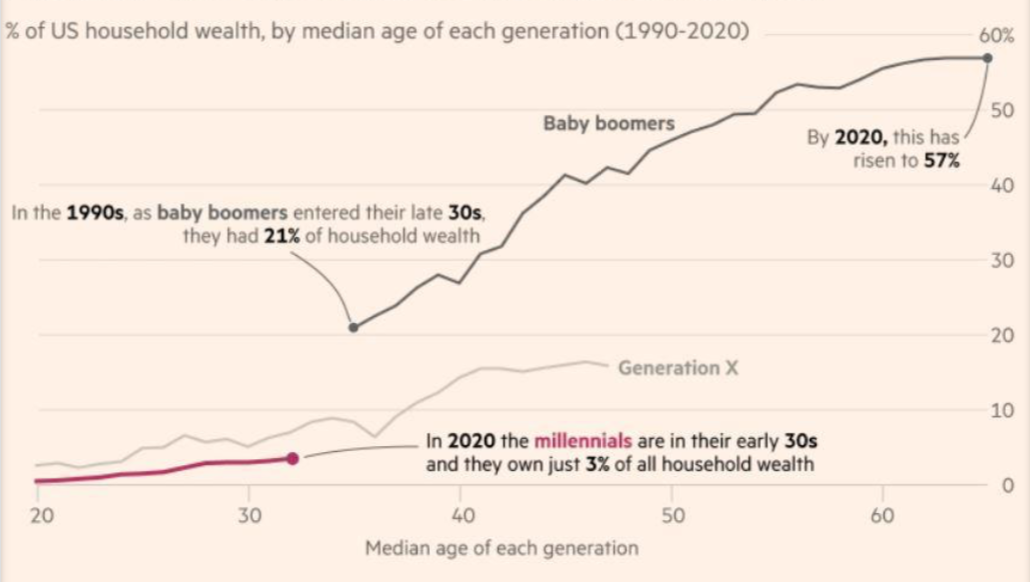

Without getting into the party politics of it, one can clearly see the interests of this rising electorate majority. Millennials, who are now in their early 30s, own just 3% of the total US household wealth, according to the Federal Reserve. The Boomer Generation entered their late 30s in the 1990s with 21% of the household wealth and they currently hold 57% of it.

Sources: Federal Reserve & FT.

People tend to vote in line with their interests, especially in times of economic crisis, so fiscal spending focused on areas important to the younger generations and broader wealth redistribution measures would appear to be baked into the cake. This will effect US sovereign debt levels and the USD, as perpetual debt and currency debasement is the ‘easy’ option out.

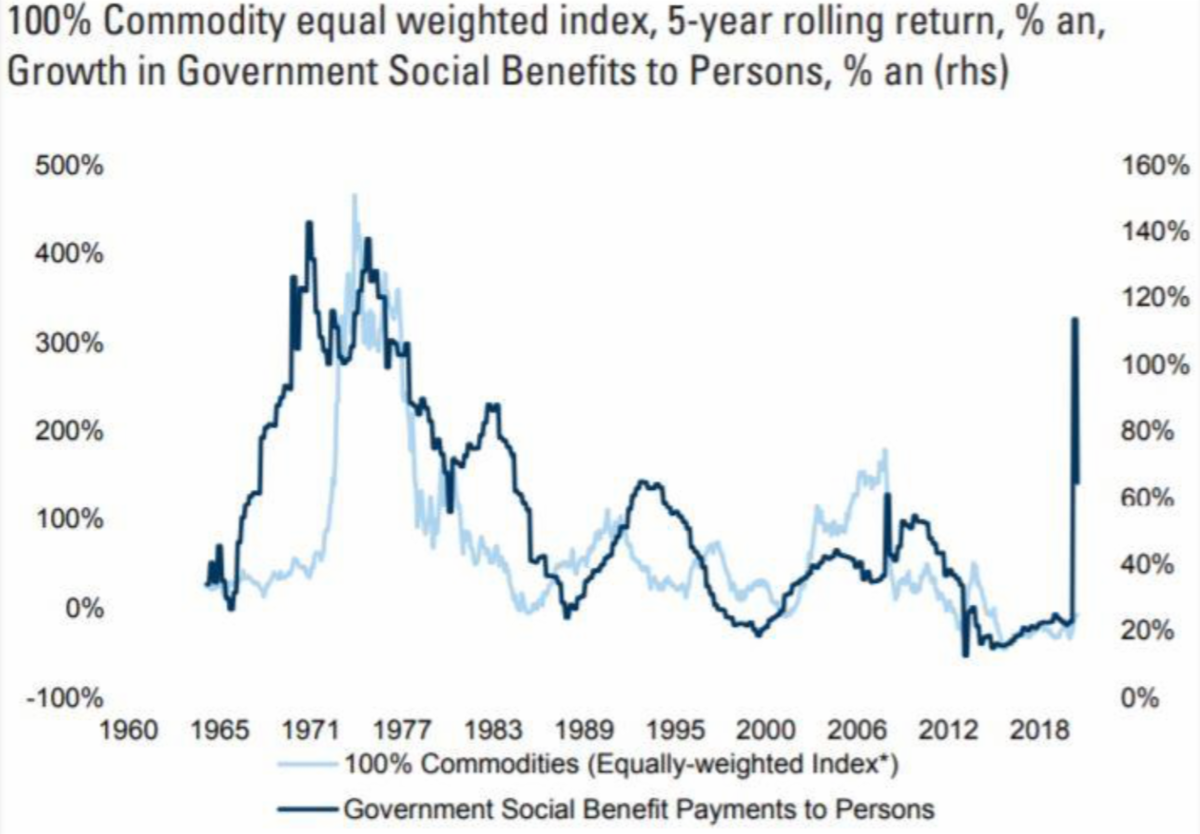

Investors should take note, that beyond the damaging debasement aspect, re-distributional policies have been associated with commodity price inflation…

Sources: AQR, Goldman Sachs Global Investment Research, Bloomberg.

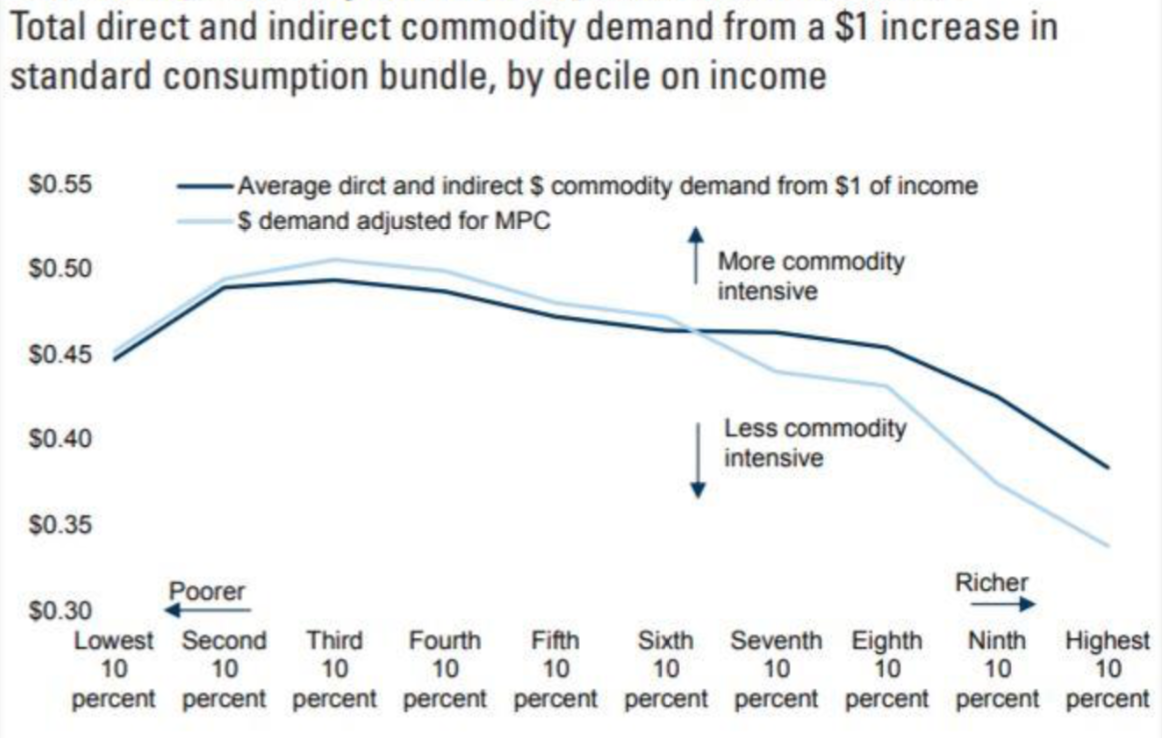

The commodity price inflation is partly driven by USD debasement but if the fiscal measures benefit the lower income households, studies shows that due to their higher commodity consumption intensity compared to wealthy households, demand also acts as a key driver for prices.

Sources: Goldman Sachs Global Investment Research, BLS, BEA.

Micro Moves:

In this weeks edition, Nikolas Joyce, our Co-Chief Investment Officer, takes a look at global money supply trends as it forms a part of his work on currency debasement related strategies.

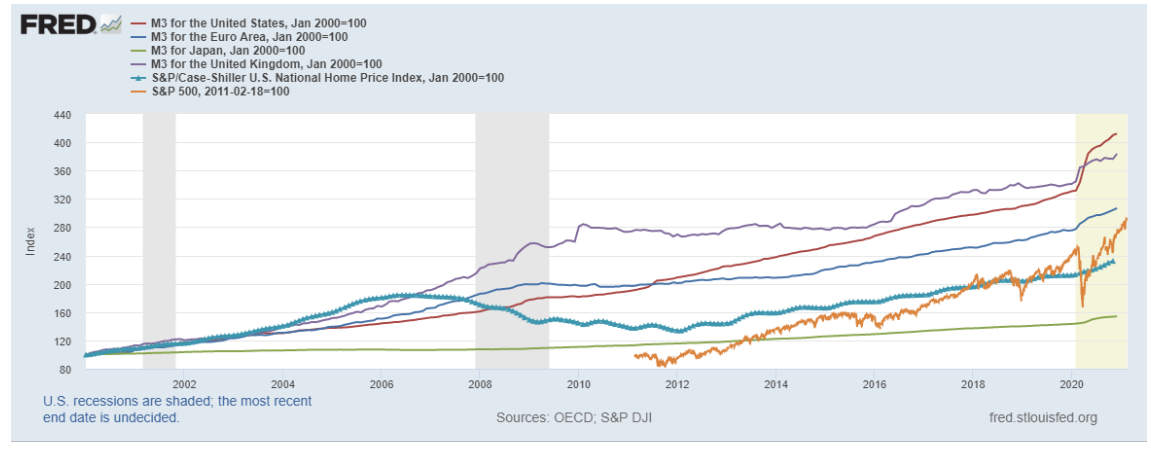

“In looking at the data related to one our key investment thesis – Currency Debasement – the money supply data for the US and globally has begun to show some interesting dynamics. This one is he money supply as M3 along with the Case-Shiller and the S&P 500. Looks like an eye-catching growth rate in the money supply in the US. Data is more informative with context so let’s look elsewhere…”

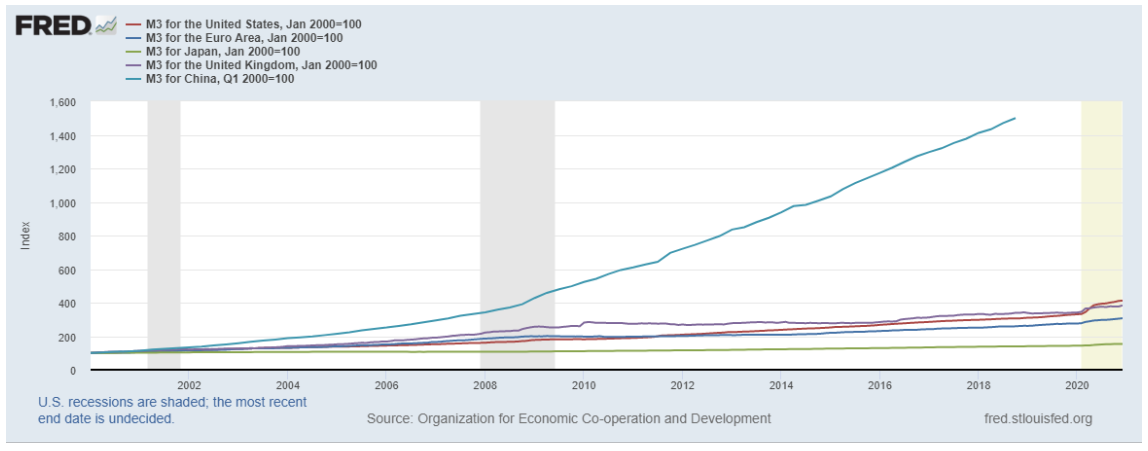

“Then you take the same set of M3 series and drop on the Chinese M3 and the picture changes…”

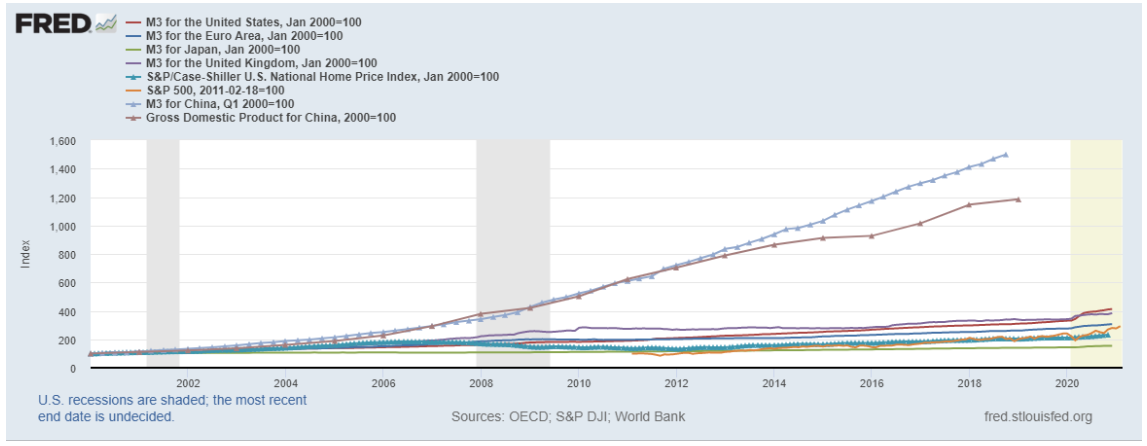

“The Chinese Money supply is growing faster than the Chinese GDP and it has done so for as long as they have been reporting this data…Currency debasement is a global game, and it is the interconnections that represents potential for real volatility and within such events lies both risk and opportunity.”

Recommended content from our explorations this week:

12 Life Lessons From Mathematician and Philosopher Gian-Carlo Rota – Some sage advice on how to give effective presentations: https://fs.blog/2021/02/gian-carlo-rota/

The DARPA WAY…can it fix US Healthcare? Regina Dugan explores how she approaches delivering breakthrough technologies, and why she has now set her sights on global health: https://hbr.org/podcast/2021/01/bringing-darpas-innovation-to-health?utm_campaign=hbr&utm_medium=social&utm_source=twitter

An overview of the investment opportunities in Emerging Markets https://www.visualcapitalist.com/emerging-markets-a-growing-set-of-opportunities/

Talking Scotland and geopolitics…In this episode of the Perch Perspectives Pod Jacob speaks with Tom Macleod. https://smarturl.it/nqjy21

A final thought…