THE STRATEGIC PERSPECTIVE – WEEK OF MAR 26, 2021

Macro Trends:

In this week’s edition Sune Hojgaard Sorensen, our Director of Macro Research, takes a look at the centralized blueprint for the decentralized crypto space being laid out by the world’s Central Banks.

“Sound money is central to our market economy, and it is central banks that are uniquely placed to provide this. If digital currencies are needed, central banks should be the ones to issue them.” – Agustin Carstens, General Manager of the BIS

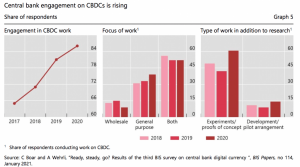

Innovation in FinTech has led to leapfrogging in many Emerging Markets and it has begun to shake up the status quo in Developed Markets. Digital Currencies has moved from the edges of things to the center of attention, the BIS AKA the Banker of the World’s Central Banks has taken notice. Globally experimentation with Distributed Ledger Technology (DLT) & Smart Contracts is well underway inside and outside the legacy system. Central Bank Digital Currencies (CBDCs) and Multi-CBDCs (mCBDCs) are coming.

Will the revolution be centralized or decentralized?

If you monitor the speeches and writings of the key architects of the global financial system amongst the world’s Central Banks, you have been able to sketch out a blueprint of their desired new financial & monetary frameworks.

Carstens speech titled; ‘Digital currencies and the future of the monetary system’ (Read it here: https://www.bis.org/speeches/sp210127.htm ) as well as the Auer, Haene & Holden BIS Paper titled; ‘Multi-CBDC arrangements and the future of cross-border payments’ (Read it here: https://www.bis.org/publ/bppdf/bispap115.pdf ) provides a clear set of insights into how they see things and as they control monetary policy and in many cases are closely linked with national regulatory bodies, it pays to keep an eye on their plans. Needless to say that handing over the keys to the system to some Crypto Anarchists is not part of their thinking.

In Carstens speech he starts by hitting a few notes on the wonders of innovation and the evolution of our digital reality; “It is stating the obvious that our economy is in the middle of a technological revolution. A combination of new digital technologies and greater online activity allows huge volumes of data to be collected, managed and telecommunicated. This has dramatically lowered the costs of many tasks. It has resulted in powerful, hyper-scalable applications that have disrupted entire industries – everything from taxis to print media. New players have entered the digital economy to provide these services. While advances in information technology and communications have been under way for many decades, the past decade has ushered in truly far-reaching changes. The Covid-19 pandemic may have further accelerated the pace of digital change. The technological revolution has also reached the financial system – and even the design of money itself.”

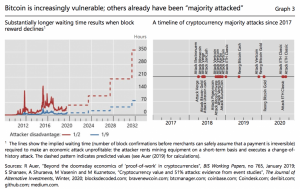

Then he gets down to brass tactics and drops the following take on Satoshi Nakamoto’s innovation: “If societies want digital money, the first fork in the road is the choice of operational architecture. Should the payment system rely on a trusted central authority (such as the central bank) to ensure integrity and finality? Or could it be based on a decentralised governance system, where the validity of a payment depends on achieving consensus among network participants on what counts as valid payments? This is the concept behind Bitcoin. Satoshi Nakamoto’s protocol envisions a decentralised consensus, with no need for a central intermediary. Yet in practice, it is clear that Bitcoin is more of a speculative asset than money. One contact recently told me that like Bitcoin is “Tesla without the cars” – observers are fascinated by it, but the actual value backing is lacking. Perhaps the Bitcoin network should be seen more like a community of online gamers, who exchange real money for items that only exist in cyber space. Bitcoin poses as its own unit of account, but fluctuations in value mean it is unrealistic to set prices in bitcoin. This also undermines its usefulness as a means of exchange, and makes it a poor store of value. The structure of the Bitcoin market is decidedly concentrated and opaque, and there is research evidence on price manipulation. Above all, investors must be cognisant that Bitcoin may well break down altogether. Scarcity and cryptography alone do not suffice to guarantee exchange. Bitcoin needs a hugely energy-intensive protocol, called “proof of work”, to safely process transactions. Currently, so-called miners sustain the system’s security, and are rewarded with newly minted coins. A sad side effect is that the system uses more electricity than all of Switzerland. In the future, as Bitcoin approaches its maximum supply of 21 million coins, the “seigniorage” to miners will decline. As a result, wait times will increase and the system will be increasingly vulnerable to the “majority attacks” that are already plaguing smaller cryptocurrencies.”

Next up Stablecoins – Carstens clearly takes aim at this imposter looking to lay claim to the throne; “What then of so-called stablecoins – cryptocurrencies that seek to stabilise their value against sovereign fiat currencies or another safe asset? Facebook’s Libra – recently renamed Diem – was initially marketed as a “simple currency for billions”. It would import credibility by being pegged to a basket of stable currencies like the US dollar and euro. More recent incarnations of Diem would be denominated in individual sovereign currencies, looking more like so-called e-money or other digital payment services. This is certainly more credible than Bitcoin. But there are still serious governance concerns if a private entity issues its own currency and is responsible for maintaining its asset backing. Historical examples show us that there may be strong incentives to deviate from an appropriate asset backing, such as pressure to invest in riskier assets to achieve higher returns. Overall, private stablecoins cannot serve as the basis for a sound monetary system. There may yet be meaningful specific use cases for stablecoins. But to remain credible, they need to be heavily regulated and supervised. They need to build on the foundations and trust provided by existing central banks, and thus to be part of the existing financial system.”

Privacy in general and so-called ‘Privacy Tokens’ in particular are not welcome either; “Some form of identification is crucial for the safety of the payment system, preventing fraud, and supporting anti-money laundering and combating the financing of terrorism (AML/CFT). There are trade-offs between access and traceability. Socially, there are many benefits to having more information, for example to prevent money laundering or tax evasion. Good identification can help here, giving law enforcement authorities new tools to fulfil their mandate. So overall, my sense is that a purely anonymous system will not work. And the vast majority of users would accept for basic information to be kept with a trusted institution – be that their bank or public authorities. The idea of complete anonymity is hence a chimera.”

The path ahead in Carstens’ view remains ‘Centralized’; “So if we take the path I have laid out just now, where do we end up? I argue that we end up with central bank digital currencies with some element of identification – that is, with primarily account-based access. Today we have the possibility to produce a technologically superior representation of central bank money. This can combine novel digital technologies with the tried and true characteristics of central banks – such as trust, transparency, legal backing and finality – that others would need to either rely on or create for themselves from the ground up.”

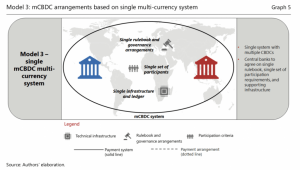

Building on this vision, the Auer, Haene & Holden Paper goes one step further and considers the framework for a “single mCBDC multi-currency system” with centralized rulebook & governance arrangements and infrastructure and ledger. This seems to be a only a few steps away from a new global Reserve Currency framework. They again take aim at the Stablecoin space as they state; “Multi-CBDC arrangements are preferable to proposals that involved the creation of a global private sector stablecoin. Instead, they look to foster a diversity of convertible national currencies and strengthen monetary sovereignty in the digital age.” They continue with the following call to arms; “…for those central banks aiming to avoid competition from global stablecoins, it is a question of safety. A positive way to prevent widespread use of private global currencies is by fostering an efficient and convenient way to convert currencies. A CBDC, compatible with others and benefiting from diverse and competitive market for services, would be a real public good. To achieve this, central banks will need to collaborate.”

“When you come at the king you best not miss” – Omar Little

As to the quote of Mayer Amschel Rothschild: “Permit me to issue and control the money of a nation, and I care not who makes its laws!” It is clear that national governments and their central banks will not be giving up the “control of the money” especially not in times of historically high sovereign debt and deficits. This does not mean the end of private digital currencies and the crypto sphere, to the contrary it will only hasten the push for new solutions. As an investor you will have to assess the risks based on your personal objectives, in our Strategic Thought titled; ‘Enter the Crypto sphere’ (Read it here: https://www.thestrategicfunds.com.pr/enter-the-srypto-sphere/ ) we share our view that it’s still very early and that the noisy calls for a revolution will likely be replaced by a grinding but lasting evolution with some great opportunities for investors.

It pays to sketch out the long-term landscape for any industry you are considering for investment, and as we have outlined here, if the powers that be (public and private) get their way the FinTech revolution will largely be centralized and build upon the foundations of the status quo.

Within the ‘Crypto sphere’ areas such as ‘Privacy tokens’ will be targeted and largely made untenable and the narrative is clearly being shaped to prepare for the launch of CBDCs and mCBDCs which is bad news for the Stablecoin players. We see real opportunity in digital infrastructure plays such as ETH & Polkadot that enables the tokenization of assets as well as the so-called DeFi ecosystem that is flourishing currently as it begins to take the digitalization of our financial system to the next level.

History shows that you can’t stop an idea whose time has come but you can help to shape it if you are the proverbial “800-pound gorilla” sitting high in the Tower of Basel. Investors should take note and take the smart approach to allocations in the space.

Micro Moves:

This week our CIO Nikolas Joyce continues the exploration of the potential impacts – good and bad – of wide-scale rollouts of CBDCs. He goes up to 30,000ft for a big picture overview and then dives down for a look at how government policy measures, including taxation, may be a part of the package.

“Governments, and central banks by extension, will be incentivized to borrow distributed ledger technology while retaining the control and monopoly on the issuance of money they enjoy today. This means fiat money may be on the wane, but it will not be replaced with Bitcoin per se.

There are multiple projects coming out of central banks that follow the Fed Coin model.

A Fed Coin would be a coin issued by a central bank, like the Federal Reserve, that would allow consumers to interact directly with vendors without the friction of retail/commercial banks and or credit card companies.

Consumers could be a “client” of central banks or several different central banks depending on the end user’s involvement in international trade and the requirement for foreign currency. A phone app would allow them to interact with different central banks as easily as using Apple pay.

If a central bank-issued a Defi Fed coin with some kind of peer-to-peer borrowing/lending facility it would not be unthinkable to see the age of 24% credit card rate be a thing of the past. A consumer could borrow at a rate closer to the Discount rate but more importantly from a Consumer Finance business point of view, it becomes increasingly difficult to see how credit card companies could maintain the stranglehold on the payments system. I am thinking of the likes of Visa and MasterCard.

There are other big implications for a Fed coin on the concept of sovereignty and citizenship.

A Fed coin, in my speculative opinion, would likely embed a taxation facility in the same way that the Ethereum project originally was purpose-built to support transaction fees.

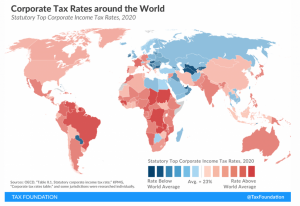

A fully blown digital future with multiple nation Fed coins would allow countries to have a much more intrusive taxation system since theoretically anything on the Fed coin blockchain could be taxed with impunity.

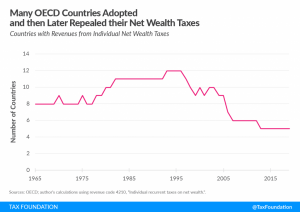

On the sunny side of things, in a near frictionless digital payments system, one can envision a market for competitive taxation policy evolving between different countries Fed coins.

Imagine a situation where a Francois Hollande-style government comes to power with a policy to lift top tax rates to 75%. With a competitive Fed coin system, an economy could see a massive and swift exit out of the high tax coin into lower tax alternatives. This possibility has interesting implications for voting patterns and the meaning of citizenship.

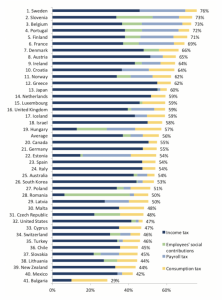

Top effective marginal tax rates in 2019 and their composition.

Source: Tax Foundation.

A small country that fancies itself as an emerging money-center could issue a coin that granted voting rights similar to a variety of current coins. With enough of the small country’s coin, your voting rights could become “citizenship”.

Most major central banks have some ongoing research in the blockchain space. There is some consensus that some form will come into existence.

In my mind, the biggest geopolitical issue related to the Fed coin is whether China views this as an opportunity to dislodge the US’ ‘Exorbitant Privilege’ and somehow insert the digital RMB as a new reserve currency.

Hopefully, competition favors liberty, and we realize an outcome that does not empower totalitarianism.”

Recommended content from our explorations this week:

A look at the long-term dollar shortage by the team at Lykeion:

https://thelykeion.com/the-long-term-dollar-shortage/

Howard Marks sums up 2020 in his latest Memo:

https://www.oaktreecapital.com/docs/default-source/memos/2020inreview.pdf

Citi GPS dives into the Crypto space here:

https://ir.citi.com/JrbQZw6ZuDGb19M7237byZdoVWxD1t6PsfdpH2hTGDszrRgg52q9SIii-YS7ddTEpFmXqSc0_wVX3vxwow8QZlzQoJbrREpr

The Integrating Investor looks at ‘Trading time as a fractal experience’ here:

http://integratinginvestor.com/trading-time-as-a-fractal-experience/

A final thought…