Risk On. Tail Risk.

Macro Trends:

In this week’s edition Sune Hojgaard Sorensen, our Director of Macro Research, takes a look at market trends for Q1 2021 and how central bank policies and fiscal measures drove investors back to ‘risk on’ mode, yet somewhat vary of the ‘tail risks’.

In the BIS Quarterly Review ( https://www.bis.org/publ/qtrpdf/r_qt2103.pdf ) the guys in the Tower of Basel explores how “Risky assets extend gains, but tail risks remain”. They state that; “With monetary policy remaining very easy, global equity markets rose in response to indications of stronger fiscal policy support, notably in the United States, and a brightening earnings outlook. Low long-term interest rates have been critical in supporting valuations. Since recent US price/earnings ratios were among the highest on record, they suggest stretched valuations if considered in isolation. However, assessments that also take into account the prevailing low level of interest rates indicate that valuations were in line with their historical average. Suggesting that equity prices are particularly sensitive to monetary policy in environments akin to the current one, featuring high price/earnings ratios and low interest rates.”

In their purveyance, they came away with a sense of “déjà vu all over again” as they sifted through the sandcastles that their monetary efforts had created. They highlight that;

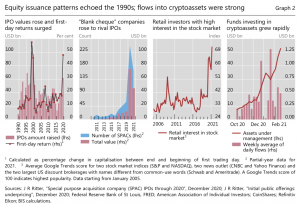

“Even if equity valuations did not appear excessive in the light of low rates, some signs of exuberance had a familiar ring. Just as during the dotcom boom in the late 1990s, IPOs saw a major expansion and stock prices often soared on the first day of trading. The share of unprofitable firms among those tapping equity markets also kept growing. In addition, strong investor appetite supported the rise of special purpose acquisition companies (SPACs) – otherwise known as “blank cheque” companies (second panel). These are conduits that raise funds without an immediate investment plan.

The increasing footprint of retail investors and the appeal of alternative asset classes also pointed to brisk risk-taking. An index gauging interest in the stock market on the basis of internet searches surged, eclipsing its previous highest level in 2009. This rise went hand in hand with the growing market influence of retail investors. In a sign of strong risk appetite, funds investing in the main crypto assets grew rapidly in size following sustained inflows, and the prices of these assets reached all-time peaks.”

As long as the music plays on, investors seem happy to ‘get up and dance’ and the World’s central banks seems content to provide an enticing playlist in the loop with a steady beat of circular reasoning, though some Emerging Market central bankers are starting to feel a little worse for wear as inflationary pressures have joined the party. The BIS Quarterly Report goes on to point out that: “Central banks across the globe continued to maintain a very accommodative stance. Policy rates stayed unchanged across most AEs and EMEs, and some central banks increased the size or pace of their asset purchase programs. In the core jurisdictions, policymakers maintained forward guidance of continued strong accommodation, despite inflation figures that surprised on the upside in December and January. Their stance reflected concerns that economic activity had not fully recovered, that economic scars could linger, that new lockdowns heralded further weakness, and that the factors behind higher inflation figures were temporary. In contrast, some EME central banks broadcast a more cautious message as inflationary pressures continued to build up during the second half of 2020.”

At the end of Q1 2021 it was as if the dark days of early-2020 had been washed away in a tide of liquidity and promises of a better tomorrow, but as the great Jason Zweig points out in the intro to ‘The Intelligent Investor;

“The market is a pendulum that forever swings between unsustainable optimism (which makes stocks too expensive) and unjustified pessimism (which makes them too cheap). The Intelligent Investor is a realist who sells to optimists and buys from pessimists.”

Micro Moves:

This week our Crypto Market Analyst, Toa Lohe, runs through some key trends currently unfolding across the crypto sphere.

Felix Martin, the author of Money: The Unauthorized Biography, wrote, “The problem is that money is not really a thing at all but a social technology: a set of ideas and practices which organise what we produce and consume, and the way we live together.” Wences Casares, a deep believer in Bitcoin, who convinced major Silicon Valley players to invest in the new cryptocurrency, understands Bitcoin’s place in an information society and makes the case for why investors should consider an allocation in the link.

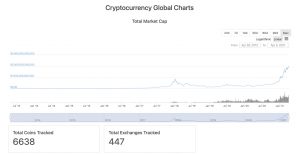

Growing up fast…The total market cap of cryptocurrencies has climbed to almost $2 trillion recently.

Source: https://coinmarketcap.com/charts/

Coinbase is profiting from the adoption. JPMorgan supports a $130,000 long-term price target for Bitcoin. But the predominant “social technology” of our time is the US dollar, times may be changing but it will likely be more of an evolution than a revolution.

Many users are searching for stability in the digital world. Stablecoins like Tether and USD Coin are competing for dominance in the crypto market – Will the Central Banks and their CBDCs step in soon? Tether released an assurance report to appease the SEC and convince potential users. Visa announced that “it will allow the use of the cryptocurrency USD Coin to settle transactions on its payment network.” The future of crypto is bright but reliant on old-world social technology to boost adoption – it’s still early and that is the opportunity and the risk investors should consider.

Recommended content from our explorations this week:

Ready for some BIG ideas? Go check out what ARK has been up to: https://ark-invest.com/big-ideas-2021/

What next for the consumer? The McKinsey Global Institute takes a look: https://www.mckinsey.com/~/media/McKinsey/Industries/Consumer%20Packaged%20Goods/Our%20Insights/The%20consumer%20demand%20recovery%20and%20lasting%20effects%20of%20COVID%2019/MGI_Consumer%20demand%20after%20COVID-19_Executive%20summary_March%202021-F.pdf?shouldIndex=false

Electrification takes a lot of Copper – learn more here: https://www.realclearenergy.org/articles/2021/04/01/to_support_americas_electrification_well_need_more_copper_than_ever_before_770754.html

A final thought…