An ageing world…

Macro Trends:

Our Managing Partner, Sune Hojgaard Sorensen, takes a look at ageing population dynamics and what it means for investors.

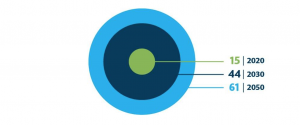

We are living longer. That’s great news. It does mean that the future will be different. Demographic, societal and economic trends are already changing rapidly. With longer life expectancy and birthrates below replacement levels comes older societies and shrinking populations. The World already has more people aged over 65 than under 5. The oldest group (85 years+) is the fastest growing segment of the older population. Currently there are 15 so-called ‘Super Aged’ countries where more than 20% of the population is over 65 – these include Germany, Italy, France and Japan. By 2030 this is forecast to rise to 44 countries, and to 61 by 2050.

The rise of ‘Super Aged’ countries (20%+ of population aged 65+)…

Source: UN

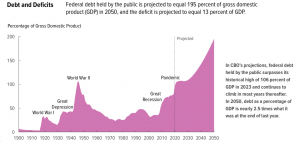

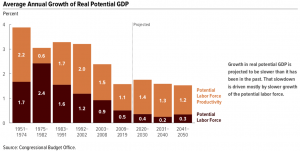

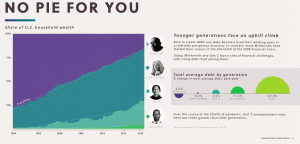

In Developed Economies, historically high sovereign debt burdens, meets lower productivity and vast generational inequalities. This is extremely pronounced in the US as the illustrations below clearly highlight. Faced with a vast debt burden – personal and national – as well as a shrinking workforce, only a significant jump in productivity rates can turn things around and provide the GDP growth required for dealing with debts and the foundation for a more equitable society. The other options are currency debasement, wealth taxes and ever larger government.

Debt, Deficits and shrinking GDP…

Meets Generational inequality….

Source: https://www.visualcapitalist.com/wp-content/uploads/2021/05/generational-power-index-2021-1.pdf

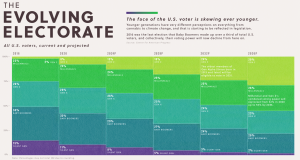

Leading to a majority of the electorate looking for significant change…

Source: https://www.visualcapitalist.com/wp-content/uploads/2021/05/generational-power-index-2021-1.pdf

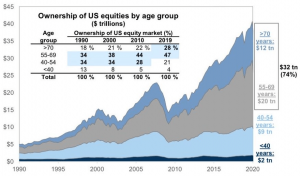

These dynamics have wide ranging implications for investors – now and in the decades ahead. While taking time to ponder these it is also worth noting that individuals that are 55 and older own 75% of US equities, as these do not pay much in terms of dividends, it seems reasonable to assume that these retirees will begin to sell off their holdings to finance their golden years.

Individuals that 55 and older own 75% of US equities (Q1 2020)…

Source: Federal Reserve, Goldman Sachs Global Investment Research.

These demographic forces may seem to move at glacial speeds but once they start to shift the impacts are felt on a global scale and across societies, economies, industries and financial markets. Investors should take note as we are at a tipping point, and there will be plenty of risks and opportunities ahead.

In this week’s edition Toa Lohe, our Crypto Market Analyst, takes a look at trust in DeFi.

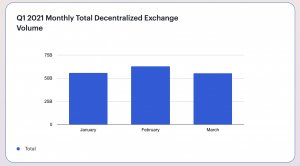

Trust is invaluable and serves as the intangible genesis block for the universalization of cryptoassets. Washington Post columnist Barton Swaim once wrote, “If you trust, you will not insist on verifying, whereas if you insist on verifying, clearly you do not trust.” Individuals around the world trust crypto but governments don’t trust the individuals operating in technological grey areas. The IRS secured an order to serve the cryptocurrency exchange, Kraken, with a customer data request on cryptocurrency traders. Despite ploys by Coinbase and Binance to have no headquarters, centralized crypto exchanges cannot escape their jurisdictions. Decentralized finance has gained enormous traction because identities aren’t required. DeFi app creators and users are anti-compliance. Their digital communities are inclusive and don’t believe in exclusivity but that might change. Over $150 million dollars have been stolen in DeFi hacks this year. Kevin Werbach wrote in The Blockchain and the New Architecture of Trust, “At some point when the invisible hand of the markets falters too severely, the visible hand of the government must reach in.” The United States government doesn’t protect funds in DeFi. Only time will tell how many new users are willing to trust in crypto and how governments around the world decide to act.

Source: https://consensys.net/reports/defi-report-q1-2021/

Recommended content from our explorations this week:

- US Congressman Tom Emmer reintroduced the ‘Safe Harbor for Forked Assets Act,’ which relates to the tax treatment of cryptocurrencies created as a result of forks. https://www.coindesk.com/congressman-emmer-to-reintroduce-tax-bill-focused-on-crypto-hard-forks

- Tether has released a breakdown of the USDt stablecoin’s reserve assets as a part of their settlement with the New York Attorney General’s office. https://tether.to/wp-content/uploads/2021/05/tether-march-31-2021-reserves-breakdown.pdf

- Point72 Asset Management announced in a letter to investors that they are ‘exploring blockchain technology and its transformative and disruptive capabilities.’ https://www.bnnbloomberg.ca/steve-cohen-s-point72-is-exploring-blockchain-crypto-sector-1.1603496

A final thought…