An exploration in search for answers to the riddles of the New New Thing…

While addressing a room full of bankers and so-called financial engineers in the aftermath of the 2007 financial crisis, Paul Volcker stated that the biggest innovation in finance in the last 20 years was the humble yet extremely convenient ATM. Since then, we have seen real advances in the so-called FinTech area that has certainly expanded on the premise of the ATM. An expanding ecosystem of digital payment solutions are a now a cornerstone of our digital reality. Investing is increasingly App based as the ways of the ancient online broker has been given the thumbs down by the swaggering Smartphone carrying RobinHooders of today. The disrupters of yesteryear have been disrupted.

Investing in innovation has historically been rewarding, especially if you can get in position as a major paradigm change gains traction. Michael Lewis introduced the following timeless observation while doing press for his upcoming book; The New New Thing, back in 1999; “It’s a new thing, or rather the new new thing. It’s easier to say what the new new thing is not than to say what it is. It is not necessarily a new invention. It is not even, necessarily, a new idea — most everything has been considered by someone, at some point. The new new thing is a notion that’s poised to be taken seriously. It’s the idea that is moments from gaining general acceptance and, when it does, will change the world.” In the world of FinTech, and based on recent interest across the media and the general public, the so-called ‘Crypto’ sphere is the New New Thing and it has been, on and off, for the last decade.

Bitcoin has so far been the key conduit of interest for this diverse sphere. As its price has gone from $0.05 to over $40,000 during the last 12 years, with plenty of volatility in between, most investors have taken notice. In the last 3-4 years, as the framework around it has evolved into something more akin to that of the traditional asset classes, more and more serious investors has entered the space.

Fear Of Missing Out (FOMO) is a powerful force, as is an idea whose time has come. It is important to note that amongst the ‘New New Things’ of the late-1990s there was several paradigm changing ideas and companies emerging amongst the general hubris and mania. Amongst all the noise, most people mistook a paradigm shift to our current digital reality as a mania, when in fact both forces were in play, intermingling as they so often tend to do during times of rapid technological progress.

I often get asked about the Crypto space by investors, who are looking for answers for how to approach this area rationally. Everyone seems to have a story of dipping their toes in the alluring waters or having a near miss with incredible potential riches or having been lured outside their comfort zone and having experienced significant losses – be it through a poorly timed market entry to the volatile realities, or the more upsetting experience of outright theft or fraud. Let’s dive into it all in search of answers…

A personal journey into the Crypt…

Let me start by sharing my personal introduction to this mysterious and fascinating phenomenon. In early 2011 I found myself sitting in a street café in the beautiful city of Barcelona. I had spent the last 5 years observing and making sense of the ‘Great Financial Crisis’, following history’s lessons and my conclusions to gold. This, and my long-held focus on the concept of investing in innovation in core economic sectors with long-term supporting trends, formed my investment thesis. On this particular day I was waiting to meet with an old friend, a software developer and all around ‘tech guru’, who was as always running a little late – he was the typical creature of the night, always in front of a screen but somehow unable to read the time. As a curious soul I always enjoyed meeting my friend as he inhabited a different world than mine – a world of Serbian hackers, online gaming, endless possibilities with wild ideas with the potential of being what Michael Lewis’ termed the ‘New New Thing’.

When we meet, we tend to drink too much espresso and the time flies with ‘blue sky’ conversations, it’s never boring and always inspirational. This spring afternoon in the balmy Catalan sun was no exception. The last time we met he had been really into a combination of online communities and online gaming and the potential for a ‘virtual world’ with real estate and business deals all conducted online in digital currencies – Dungeons and Dragons meets Monopoly in cyberspace.

This time my tardy friend had the next level – A great tale of the future – A cyber currency, truly independent and finite in nature developed by an anonymous collective with a mysterious leader; who was known as Satoshi Nakamoto – who appeared to be a nerdier version of the elusive Keyser Söze from the movie ‘The Usual Suspects’.

The great invention was something called Bitcoin, and the story fascinated me enough to spend some time digging a little deeper online that same evening. Our conversation had concluded with us agreeing that it was a great story and that a movie should be made about it all. Furthermore, that it might just find some traction outside of the ‘hackers sphere’ as people had just gone through a major financial crisis where the fabric of society had been torn and trust in governments and especially financial institutions was evaporating. People had started to question everything and to seek answers and solutions in alternative places. These were dynamics I had also seen at play in the precious metals space, and various forms of online precious metals based programs, that provided some of the same principles and features that these ‘digital currencies’ supposedly would offer, were gaining traction.

At the time I could not really see its benefits over title-held physical allocated gold held outside the banking system for wealth protection. As a means of payment its functionality appeared suboptimal compared with existing platforms such as Paypal and traditional players such as SWIFT and the global credit card providers – too cumbersome, a little shady, with no real infrastructure, a limited network of dedicated but marginal participants and extremely volatile valuations. The appeal, beyond playing with the ‘New New Thing’ with the cool kids, seemed to be limited to money laundering and circumventing capital exchange controls. I put it on my mental ‘Things to watch’ list and moved on with my life and business projects. The price of Bitcoin then was about that of a good double espresso.

I admit to having had moments of engaging in wishful thinking of; “if only I had…”, at various points since then, especially at those intervals when the price of Bitcoin went to the Moon. However, as an investor on a personal level and as a fiduciary entrusted with the stewardship of other people’s hard-earned wealth, my focus has always been first on the ‘return of the money’ over the ‘return on the money’ and for all its promise the crypto space has only recently begun to meet my criteria for transparent and secure ownership.

An emerging landscape…

The inherent value of cryptocurrency as an alternative method to store and transmit units of value has by now gained acceptance from a critical mass of investors, technologists, regulators, merchants, entrepreneurs and consumers. It’s clear that cryptocurrency is more than a passing phenomenon. Many smart people believe that it represents the beginning of a new phase of technology-driven markets that have the potential to disrupt conventional market strategies, longstanding business practices and established regulatory perspectives – all to the benefit of consumers and broader macroeconomic efficiency as the middle-man, who has been displaced in other areas of our digital reality and even the financial markets, is finally sent the way of the open outcry markets and the bank teller.

The broader growth has been driven largely by venture capitalists investing in the FinTech technology infrastructure and other investors seeking to profit from price fluctuations in the crypto space, rather than by consumers, investors and entrepreneurs actually using cryptocurrency or token based offerings to replace, at scale the, legacy market frameworks and their guardians. Therein resides the opportunity for discerning investors today. It is still early.

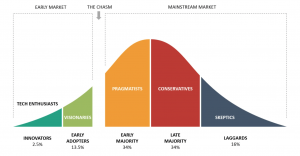

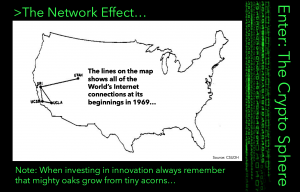

One can argue that in recent years the Distributed Ledger Technology (DLT), Digital Assets and the evolving Decentralized Finance (DeFi) support system as well as the media darlings or bêtes noires depending on the outlet; the cryptocurrencies – in particular, Bitcoin – has begun to demonstrate their value. As with most things the value is in the eyes of the beholder, apart from the declared fiat-currency prices of crypto tokens, a perceived “inherent value” of an emerging crypto ecosystem, can be discerned. This includes the core decentralized concept, the operational technologies, the integrity of the cryptographic codes, and the decentralized networks. The growing network effect instills confidence that these new vehicles for the expression of value and utility carries attributes with lasting value and relevance powerful enough to bridge the ‘Chasm’.

Clearing the Chasm: The path of innovation…

Source: B2U

In his excellent 2002 book: ‘Engines that move markets – Technology investing from the railroads to the internet and beyond.’ Alasdair Nairn states; “In the case of the Internet, the losers are easy to categorize but difficult to identify. Unlike most previous technology changes, there is no obvious industry being supplanted. It is not railroads replacing canals, or the telephone replacing the telegraph. However, it is about electronic replacing physical delivery, which is a change that applies across a whole range of industries, not just one sector. The financial sector, though, is larger and likely to be more profoundly affected. There have been early moves in the stock-broking sector and to a lesser extent the banking and insurance sectors, but these are only the tip of the iceberg. It is entirely possible that brand new companies could be created with cost structures quite different from the current players.(…) The problems of out- of-date and inadequate computer systems, the so-called legacy problems in many financial services companies, are such that there is little possibility of them being able to react in time to prevent a sharp erosion in their business from competitors who can use the technology of the internet to full effect. Margins are fat in the finance business, just as they once were in the PC business. This looks set to change. It will be possible to automate the manufacturing of financial products through to their distribution to the end user and to do it all electronically. (…) The financial sector as a whole has relied on the lack of transparency to maintain its margins. The Internet will remove this lack of transparency by allowing the various parts of the supply chain to be broken up and competition to attack each of them.”

This has all proven very pertinent as these dynamics has all come to pass in the decade since. Today the questions are if the unfolding crypto network is the next layer in this powerful transformation of our economic and financial systems and if so to what degree? Who will be affected positively and negatively and how can investors best position themselves to benefit from this transformation?

Tinkering with mousetraps…

Channeling Mr. R.W. Emerson’s wisdom; “Build a better mousetrap and the world will beat a path to your door.” The real question is do we actually have ‘a better mouse trap’ in front of us?

As mentioned in the intro, the FinTech space has already provided real progress in payments and the E-commerce infrastructure. And in the financial market space we have seen an ongoing evolution, since the days of the ‘scritta’ by the canals of Venice, in the ways people have raised funds for their ventures – large and small – from the crowd. This has taken many forms as we have experimented with different models and today we have a multitude of ways for entrepreneurs and companies to get funded such as traditional loans, bonds, private equity & public equity, and for investors to participate.

Our current system, especially in the publicly listed space, has undergone significant evolution in the last 50 years with the move from the ‘open outcry’ system to a purely electronic format and with many exchanges combining multiple global markets. Since 1971, when the NASDAQ first introduced electronic trading and the modern IPO, we have seen nothing short of a revolution with the incumbent cozy ‘good ol’ boys club’ of the established exchanges being brutally awakened by the onset of ‘e-trading’ and low-cost brokers providing increased access to global markets with instant pricing and a ‘fire hose’ outlet of information all via the wonders of the internet. Today competition has shaved the fat fees down significantly and high-frequency trading now accounts for the majority of the major markets. Comprehensive – but by no means perfect – rules, regulations and oversight is the norm providing issuers and investors with a relatively predictable, transparent and functional liquid market place. With products such as index funds and a cacophony of ETFs, the average investor can already access most global public market assets relatively frictionless.

This new digital asset framework and the related tokenization process could offer an improved ‘mousetrap’. Central Banks and both legacy financial players and ventures rising from the crypto sphere has been testing and implementing aspects of the distributed ledger technology and smart contracts within the existing system in order to further rationalize their ‘back office’ and market operations. At first this may lead to a rationalization of the current ‘alphabet soup’ of service providers that handle processing and record keeping for traditional markets, such as CREST. Some exchanges may establish their own options or look to purchase some of the best operated crypto exchange operators to add a new line of revenues and in order to provide a comprehensive range of services, not to mention to tap into the energy of the current zeitgeist.

Over the long term, should ‘the vision’ unfold and global investors and entrepreneurs increasingly embrace the new model, the question is if over time markets will transform from the current public centralized nature to a private decentralized format.

As for the mania, tall tales, fear and greed and outright fraud, none of these developments are all that surprising taken in the context of the history of financial innovation – surely some less than forthright characters set up shop in the alleys around 68 Wall Street back in the late 1790s and whispered alluring tales of massive gains with little risk to anyone passing who would listen. And certainly the madness of crowds is nothing new nor is tales of confused regulators, and fierce lashing out by the established order against any new challengers to their profitable system is a given.

Entering Crypto: Caveat Emptor…

So as a fiduciary, who takes their responsibility seriously, can you really signoff on an investment into this space? The answer should be yes, if you have done your due diligence and found supporting fundamentals that match your mandate. It – crypto tokens and related ventures – should in my opinion be considered akin to traditional VC investing – high risk/high return with increased illiquidity risk – and once the continuous boom/bust cycle clears out the hubris it may very well turn out to be one of the great wealth creation opportunities of our time.

One is well served to heed the old trading adage that; “Liquidity is a coward, it’s never around when you really need it.” By association illiquid markets are notoriously poor indicators of value. But as Shakespeare put it; “There is a tide in the affairs of men, which taken at the flood leads on to fortune. Omitted, all the voyage of their life is bound in shallows and in miseries. On such a full sea are we now afloat. And we must take the current when it serves, or lose our ventures.” With a coherent clear-eyed approach and proper risk management this is the kind of opportunity serious long-term investors must look to harness.

You may want to take diversified and broad approach – as it may be, as is often the case when new innovation and discovery interrupts – that the real opportunity is to be found around the edges, in the less spectacular and the more mundane. It was Mr. Levi and the sellers of shovels and provisions who rode the California Gold Rush to fortune. Revolutions often lead to spectacular episodes of wealth destruction whereas the quieter cousin, evolution, with the benefit of compounded interest dynamics, often ends up the real wealth creator.

A generational wave will eventually drive all things digital to new levels, my kids navigate a digital world with the swipe of a finger and I recently discovered that they where making virtual money in the online game; Minecraft by selling their constructions and innovations to players around the world. We live in interesting times, stay curious yet with an all important sense of critical and independent thought. It has served mankind well for millennia.

A Strategic approach to Crypto…

At the Strategic Funds we have been monitoring the crypto sphere for a long time and have identified opportunities that warrant attention. From there we have devised investment strategies based on our experience in traditional markets combined with the input of a select group of digital asset native investment managers. Collectively this has enabled us to create a selection of diverse coherent clear-eyed approaches, as always with a focus on effective risk management, for harnessing this emerging opportunity. In 2021 we will be introducing these to Accredited Investors. Let us know if you wish to learn more.