Investment Implications of Russia’s Invasion

Early this morning Ukrainian time, Russian President Vladimir Putin gave his second strident speech of the week about Ukraine. Putin announced he had approved a “special military operation” in Ukraine to protect Donetsk and Luhansk – recently recognized by Russia as independent republics. Putin said Russia’s goal was to “demilitarize” and “denazify” Ukraine. He warned all Ukrainian soldiers to lay down their arms in advance of the Russian operation. He accused the Ukrainian government of “genocide.” Putin warned other countries not to attack Russia, alluding to Russia’s nuclear weapons and other high-tech weaponry.

Shortly after Putin’s speech, Russian military forces began a large-scale operation against Ukraine. Russian missiles struck at key Ukrainian military sites in cities throughout the country, like Kyiv, Kharkiv, and Odesa. Russian airborne soldiers have been confirmed on the ground fighting for control of key installations, including airports, outside of Kyiv. Video footage of Russian armor and soldiers entering Ukraine from Belarus in the north and Crimea in the south are real. Ukraine has declared martial law and says 40 of its soldiers are already dead in the fighting.

The impact on Russia’s decision to invade Ukraine will reverberate throughout commodities markets. Before Putin’s announcement, the most likely geopolitical scenario was that Russia would use its military deployments to create the leverage necessary to secure a political arrangement with Kyiv, one that would see Ukraine became friendlier toward Russia, or at minimum, more neutral. Instead, Russia has chosen a path of military force to secure its influence over this key buffer territory.

Russia fears national security threats that can utilize the flat expanse of the Northern European Plain to threaten Russia’s main population centers. In the words of 18th century Russian Empress Catherine the Great: “I have no way to defend my borders but to extend them.” Now that diplomacy and de-escalation are off the table, the situation in Russia and Ukraine is likely to get worse before it gets better. Russia’s initial operations seem designed to degrade Ukraine’s ability to resist Russia’s military offensive, and will likely be followed by further incursions into Ukrainian territory, the goal being to decapitate the Ukrainian government and install a pro-friendly Russian one.

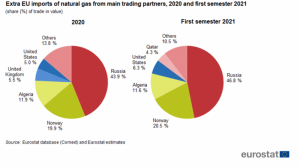

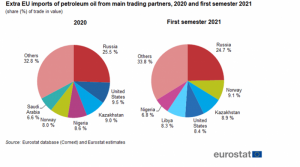

The question is how far the West will go in imposing sanctions. As we type this, U.S. President Joe Biden has not yet given his address on sanctions, but there are impediments to Biden going too far. The next three charts show why.

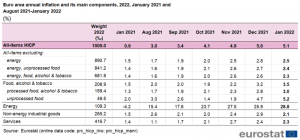

Europe is highly dependent on Russia for energy imports. While the U.S. has become a major energy exporter, and the U.S. has been coordinating with partners like Saudi Arabia and Qatar to increase potential global supply, as well as making progress on returning Iran to the nuclear deal that would allow Iranian crude to get back on global markets – the U.S. and its partners cannot by themselves account for European energy demand. That is why Brent crude has surged to over $100 a barrel, and why European natural gas and coal futures have surged from 23 to 62 percent over the last 24 hours. This is far from over. Russia has opted for a military invasion of Ukraine, which means Russia will not stop until it achieves its objectives. What the market is reacting to thus far is just the prelude.

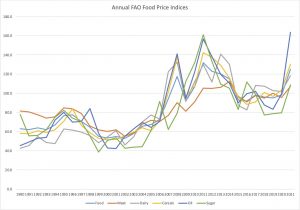

Energy is the most critical commodity to watch – but far from the only one. Food prices are also a major issue going forward, especially cereals – which both Russia and Ukraine are massive global exporters of. Food prices are already extremely elevated across the board. They will continue to rise now. Russian and Ukrainian wheat exports account for roughly a quarter of global exports. Russian and Ukrainian barley accounts for almost a quarter of global barley exports. Ukraine is the fourth largest global corn exporter. Fertilizer is another huge variable to watch going forward. Russia and Belarus – the latter of which declared force majeure on its fertilizer exports just last week – are key players in the global fertilizer market, where elevated prices will still go higher. That is why we have been writing about the upside potential to wheat and fertilizer prices at The Strategic Funds for months. This was one of our possible scenarios – and one of those times where it gives us relatively little pleasure to say we were right. Just imagine if Turkey heeds Ukraine’s requests and tries to block Russian ships from entering and exiting the Black Sea via the Bosporus – global food prices could make the recent price spikes look puny by comparison.

Last but not least: Russia is the top global exporter of nickel in the world, critical to stainless steel production and to those electric batteries in the Teslas everyone seems to want to drive. We did an extended deep dive into global nickel markets last September; you can revisit the fundamentals of that market by clicking here. To make a long story short: everything from that stainless steel dishwasher to that electric car you were hoping to buy is likely to see supply chain disruptions and serious prices increases.

The key to watch going forward will be just how tough Western sanctions against Russia are. The U.S., the EU, and its partners will want to impose serious costs on Russia for violating Ukrainian sovereignty. But they must balance that geopolitical need to impose costs on Russia with their own vulnerability to Russian commodity exports. A globalization recession is in its initial phases, and the Russian invasion of Ukraine is not an exceptional event. It is a harbinger of what is to come over the next decade, as supply chains find themselves hostage to national security considerations. These sorts of disruptions do not take place over long periods of time – they take place in the form of sudden, abrupt disruptions.