The Future of Platinum-Group Elements after Russia’s War in Ukraine

Regular readers of the Strategic Perspective series were well-prepared for the commodity after-shocks of the unexpected Russia-Ukraine War. It is common knowledge that Russia is a major exporter of oil and natural gas. Just the fear of disruption of Russian energy exports has sent oil and natural gas markets into a tizzy. Russia, however, is not just a Slavic Saudi Arabia. It is also a major exporter of several other important commodities. In the last 8 months, we published pieces in the last 8 months on wheat (click here), nickel (click here), aluminum (click here), and fertilizers (click here). Russia is the world’s largest exporter of wheat, nickel, and fertilizers, and the second largest exporter of unwrought aluminum. Indeed, we even warned readers in December that Russia’s floating wheat export tariff and Ukraine’s wheat export limits might send wheat prices much higher in 2022, and that the UN’s Food and Agriculture Organization was being too sanguine about wheat prices. As we said in December: “If the pandemic has taught us anything, however, it is that nothing should be taken for granted.” Old habits die hard.

Wheat Prices at Record Highs

Source: https://markets.businessinsider.com/commodities/wheat-price

Russia’s invasion and the subsequent bevy of U.S. and European sanctions against Russian exports, as well as signals from Moscow that it intends to limit the export of several commodities (President Vladimir Putin has been coy thus far on exactly which commodities, though the Russian government has already restricted some fertilizer and chemical exports), have fundamentally changed global commodity markets. A multipolar world has been brewing for almost a decade, but now it is unambiguously here – and here to stay. Even if Russia were to declare a ceasefire, its relationship with Europe and global markets has irreparably changed. Don’t expect things to go back to where they were before. We exist in a fundamentally new reality, and investors that cling to past mental maps and market patterns will suffer for their lack of flexibility.

As a result, we will be revisiting many of these commodities in future editions of this series. Previous work provides useful context and perspective, but the change in the status quo has reshaped the future. In the meantime, however, we have to address a commodity that didn’t get the full Strategic Funds treatment before Putin decided to make his move in Kyiv, another critical mineral commodity in which Russia is a dominant global player: platinum. Platinum is both a metal but also the short-hand for platinum-group elements – six metals with similar physical and chemical properties that usually occur together in nature. These six metals are platinum, palladium, rhodium, ruthenium, iridium, and osmium. Russia is the top global exporter of palladium in the world, responsible for almost a quarter of global palladium trade. Russia is also a significant but much smaller exporter of both rhodium and platinum itself, accounting for 4 percent and 9 percent of global exports respectively.

Importing Markets of Russian Platinum-group Elements

Source: ITC calculations based on Federal Customs Service of Russia statistics. https://www.trademap.org/Country_SelProductCountry_Map.aspx?nvpm=1%7c643%7c%7c%7c%7c7110%7c%7c%7c4%7c1%7c1%7c2%7c1%7c%7c2%7c1%7c1%7c3

Platinum-group elements (PGEs) are a versatile group of metals with several industrial uses. Most are probably familiar with platinum’s use in jewelry, which corresponds to roughly half of platinum’s use in the world today. The top use of platinum, however, is in your car’s catalytic converter. Catalytic concerts are exhaust emission control devices that make cars less pollutive by reducing the toxic gases internal combustion engines emit. Since 1975, all U.S. vehicles on the road have been required to have catalytic converters. While roughly half the world’s platinum is used in catalytic converters, almost two-thirds of the world’s palladium is used in this manner. Electric cars powered by batteries are actually bad for platinum prices, because those cars rely on other critical minerals like lithium and nickel. Platinum, however, is critical to modern fuel cell technology, which is the backbone of the catalyst that would allow hydrogen to power a car. (If you missed our hydrogen deep dive, click here to jump in.)

PGEs however have a much wider range of use than in cars. The chemical industry, for example, relies on platinum or platinum-rhodium alloys to manufacture the raw materials necessary to produce fertilizers. PGS are also critical to the refining process that turns crude oil into gasoline you can put in your car. Because PGEs are so resilient to tarnishing and chemical attacks and are capable of tolerating elevated temperatures, they are an ideal element for several industrial uses. The process of making LED screens, on which you might be reading this article, requires PGEs, as does the computer hard disk you have stored all of your photographs on. PGEs are present in semiconductors, and even have medical applications due to their resistance to corrosion, playing a pivotal role in many medical devices, such as pacemakers. And all of that is in addition to being sought after as a precious metal.

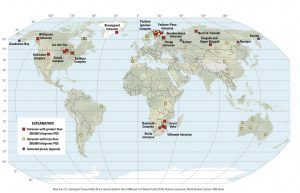

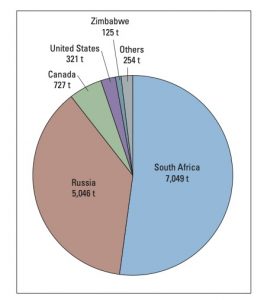

There’s just one problem: as with so many of the mineral commodities we have survey in this series, supply of PGEs is concentrated in a small number of geographic locations in the world. Here the data is also slightly confusing. Technically, in 2020, the United Kingdom was the largest PGE exporter in the world, due largely to stockpiles held by investment funds. South Africa, however, is far and away the largest PGE producer in the world, and accounts for more than 90 percent of global reserves. That is not a typo: even though Russia has surpassed South Africa as the largest palladium producer in the world, Russia’s overall platinum reserves make up just 6.2 percent of South Africa’s total reserves. The only other three countries with any reserves or production of note are the U.S., Zimbabwe, and Canada, which together have roughly the same amount of reserves as Russia.

Map of Global PGE Deposits

Source: https://pubs.usgs.gov/pp/1802/n/pp1802n.pdf

Ironically, when Spain’s conquistadors were mining the new world for its precious resources, they didn’t think much of the PGEs they often found mingled with gold deposits in Ecuador and Colombia. Platinum was only identified as a new metal in 1750, and it took another three-quarters of a century for its PGE brethren to be identified as well. And it was not until the late 19th century that anyone realized PGEs might actually be useful. Once the world got smart, however, PGEs became mission critical. For the U.S., platinum was the second most sought after strategic raw material for its World War I effort. PGEs were just as important in World War II and in the Cold War, and despite increasing demand for PGEs, the U.S. still depends on imports for 90 percent of its consumption. Indeed, the U.S. is the largest importer of PGEs in the world at 18 percent of the global total, 17 percent of which came from South Africa and 12 percent of which came from Russia last year.

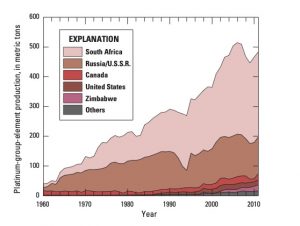

Historical Platinum Production by Country

Source: https://pubs.usgs.gov/pp/1802/n/pp1802n.pdf

Before 1960, Canada, Colombia, and Russia were the top producers of PGEs in the world. New discoveries in Russia and South Africa in the 1960s dwarfed all previous platinum discoveries. Here are two remarkable statistics from the U.S. Geological Survey: From 1900-2011, 95 percent of PGEs were mined after 1960 and 90 percent of that production came from either South Africa or Russia. Combined, Canada, the United States, and Zimbabwe account for a paltry 5 percent. There are essentially just two sources of PGEs in the United States: a company in Montana that produces 15,000 kilograms per year (less than $1 billion worth of platinum) and small amounts of PGEs recovered as byproducts from copper-nickel mining in Michigan – which are sent abroad for refining. It is no coincidence that PGEs were included on the U.S. Department of the Interior’s list of 35 mineral commodities critical to U.S. national security.

Last summer, we were worried about South Africa for its own unique reasons. Protests around allegations that former President Jacob Zuma was guilty of corruption turned into the worst violence in South Africa in over a decade. At one point, the South African government deployed 10,000 soldiers and called up 25,000 more reserves just in case they needed to restore their monopoly of force. At the time we noted that South Africa is a major producer and exporter of three geopolitically scarce commodities: platinum, manganese, and chromium. Suddenly the fact that South Africa is the third best performing stock market in the world in the last 120 years makes a little more sense.

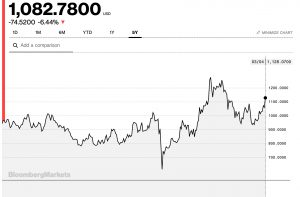

Platinum Prices

The Russia-Ukraine War could result in Russia blocking PGE exports to the world as soon as next week. Moscow is looking for ways to respond to the sanctions being imposed against it that hurt the West, but don’t hurt it too much. That means oil and natural gas will be sanctions of last resort – but could mean PGEs and other Russian mineral commodities will serve as ideal candidates. That is speculative of course: Russia has not said it will ban export of PGEs, just that it is considering which commodities to impose bans on. In the meantime, expect the rally in PGEs to continue over the next few weeks due to fear and uncertainty over the reliability of Russian supply in the future. This is all good news for South Africa, a country that has a lot going for it geopolitically these days. Expect both the U.S. and Canadian governments to support domestic production and even refinement of PGEs in the future as well.