The CBDC Battle

In this week’s edition our Crypto Market Analyst, Toa Lohe looks at the 3-way battle that is brewing in the Central Bank Digital Currency space and the broader crypto sphere.

Gary Gensler told NPR once upon a time, “Markets work best when there’s a cop on the beat.” His brevity forecasts competition between central banks around the world because the People’s Bank of China (PBOC) may become the unofficial cop on the beat monitoring and influencing the Global South’s markets. It has joined the “mCBDC bridge” and the recently-appointed Governor of the PBOC announced, “We believe that Bitcoin and stable coins are encrypted assets. Encrypted assets are an investment option, not the currency itself. It is an alternative investment, not currency itself. Therefore, we believe that crypto-assets should play a major role in the future, either as an investment tool or as an alternative investment.” Despite unresolved issues in their banking system, the Chinese have applied Mario Draghi’s dictum, “to do whatever it takes,” to their administration of national and, potentially, international financial affairs.

The Chinese know that the financial fishbowl built by the West decades ago doesn’t have legacy control over the future flow of money around the world. China is positioning to provide the FinTech infrastructure of tomorrow and with it, control of the capital flows in much of Asia and beyond. An old Chinese proverb says, “If you want to know what water is, don’t ask the fish.” If members of the dollar-denominated financial world are the fish then fresh perspectives are needed to unseat the PBOC’s advantageous position in global markets.

With much of the West’s central banks and regulators off ‘tilting at windmills or trying to close the proverbial barn door’ on can only hope that free decentralized innovation from the private space comes to the rescue to provide another way. Investors should watch this space, we certainly will.

CBDC in the wild – Watch China’s e-RMB roll out in action here:

This week Sune Hojgaard Sorensen, our Director of Macro Research, shares some insights on how “happy workers” could be a data point for generating alpha when assessing companies.

A 2019 report by Bank of America (BAML) titled; ‘Extracting alpha from Glassdoor’ took data sets from innovative alternative data miner Thinknum and tested the thesis. Here are some perspectives from it.

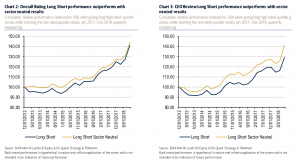

“In previous work, we found that Glassdoor ratings were effective signals of social scores within an Environmental, Social and Governance (ESG) framework. Here we find that employee ratings can lead to better risk-adjusted returns. Stocks with high ratings would have outperformed those with low ratings by almost 5ppt per year from 2013 to 2018, and would have offered a Sharpe Ratio of 1.18 vs. 0.53 (when averaging across the rating categories).”

Source: BAML

It would be interesting to see an updated version capturing the ‘work from home’ sentiments and related company share performances in this new environment. Navigating the ‘Signal and the Noise’ is always a challenge but looking into alternative data can be rewarding.

Recommended content from our explorations this week:

Listen to what the consequences of an independent Scotland is here: https://smarturl.it/nqjy21

Visualize the power consumption of global Bitcoin mining here:

https://www.visualcapitalist.com/visualizing-the-power-consumption-of-bitcoin-mining/

Take a ‘short’ journey into the world of Carson Block: