TradFi to DeFi – The Way of the Leapfrog…

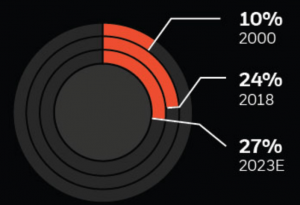

Emerging markets have been rising for a while – They are populated by billions of young people with smart phones who have already leapfrogged over TradFi to FinTech, DeFi is just a swipe of a finger from there…

An appetite for (creative) destruction…

Let’s dissect the ‘Leapfrog’ – The main idea behind the concept of leapfrogging is that small and incremental innovations lead a dominant company to stay ahead. However, sometimes, radical innovations will permit new companies to leapfrog the ancient and dominant company. The phenomenon can occur to companies but also to regions and nations, where a developing country can skip stages of the path taken by developed nations, enabling them to catch up sooner, particularly in terms of economic growth and adoption of new technologies.

Joseph Schumpter introduced the notion of ‘the gales of creative destruction’ in his 1942 book; Capitalism, Socialism and Democracy. His hypothesis proposes that; “companies (or nations) holding monopolies based on incumbent technologies have less incentive to innovate than potential rivals, and therefore they eventually lose their technological leadership role when new radical technological innovations are adopted by new companies (nations) which are ready to take the leap. When the radical innovations eventually become the new technological paradigm, the newcomers leapfrog ahead of the formerly leading firms (nations).”

The Emerging Leapfrog…

Leapfrogging as a concept has become increasingly relevant to the understanding of the trajectory of key emerging nations, many of which have leapt ahead on the development curve without the gradual transition, by foregoing many of the intermediary steps that developed nations undertook. Sometimes less is more – if you were starting to build a city, an industry or an economy today from scratch you would be wise to take note of the best practices and the most advanced and proven systems and technologies.

Emerging nations increasingly harness emerging technologies to leap up the development scale…

Illus: M.N. Sharif.

The last century has seen enormous technological advancement that helped transform the global economic, political, social, and environmental landscape dramatically. The velocity of changes witnessed in the technological sphere, especially in the last 3-4 decades has been significant. It took the spindle, the hallmark of the 1st Industrial Revolution, 120 years to spread outside of Europe – by contrast the internet permeated the globe in less than 10 years. Technology users who are late in the adoption cycle have therefore been able to skip a whole generation or bundle of technologies since a more efficient and high-tech alternative to such conventional technology would have been in existence within a short period of time. The ability of late adopters to use emerging technologies to skip a generation of technology and leap to the very latest technologies has proven powerful.

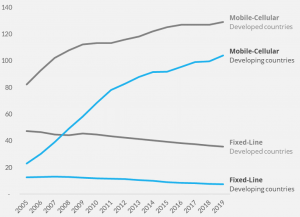

A great example of this is the personal computer. The personal computer and mobile phones, were developed and adopted for personal use in developed markets many years before the emergence of the smartphone. But emerging nations experienced a different transition, these markets never owned a desktop computer or fixed landline phones. Instead, communities and individuals leapfrogged them entirely, opting instead to adopt low-priced android smartphones that provided a faster and cheaper way of communicating digitally and accessing the internet. For example, 360 million people in South East Asia access the internet via mobile phones, representing 90% of total usage.

The mobile leap – EM/DM Mobile-Cellular vs Fixed-Line Subscriptions (per 100 inhabitants)…

Source: Melbourne Microfinance Initiative.

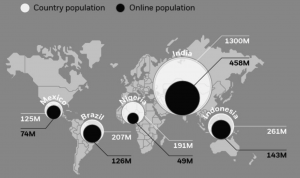

Asia has been the leader in this approach. According to the McKinsey report titled; How Asia can boost growth through technological leapfrogging; “The number of internet users in Asia has grown more than the number elsewhere, and the region is now home to half the global total. Asia’s e-commerce market revenue is projected to reach $1.4 trillion in 2020, nearly triple the market revenue in the United States. Mobile e-commerce spending accounts for 74 percent of total spending on e-commerce in Asia, compared with 37 percent in Europe and 31 percent in North America. App downloads have grown more in the region than in the rest of the world, reflecting Asia’s mobile-first approach to the internet, and its consumers are more likely to spend more time on those devices. The region accounted for 41 percent of all mobile app downloads in 2019.” Other regions with large and youthful populations are following in Asia’s footsteps – Africa & the Middle East and LatAm – are finding their own species of the ‘Leapfrog’.

Billions of young people are still due to get online in emerging nations…

Select EM nations’ online user vs current population.

Source: Blackrock

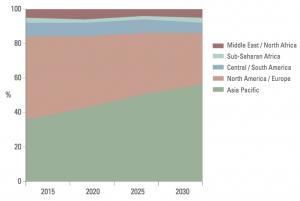

Global ‘Middle-Class consumer’ spending is increasingly driven by EM nations…

Source: OECD

EMs are gaining a growing slice of the wealth pie – The EM percent of global wealth (2018)…

Source: Credit Suisse.

Who needs a bank on every corner?

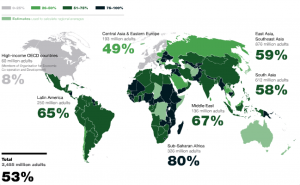

In Emerging Markets, with little access to TradFi and already adopters of FinTech the leap to DeFi is smaller than in Developed Markets…

Consumers and investors in EMs do not have access to traditional financial services nor is the ‘a bank on every corner’ infrastructure likely to ever be a reality.

The percentage of total adult population who do not use formal or semi-formal financial services.

Source: IMF

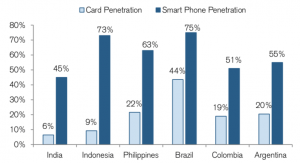

They are already leapfrogging with FinTech – mobile payments and financial services is the norm…

Emerging Markets are characterized by high smart phone penetration but low bank card penetration.

Source: Credit Suisse.

Innovation is taking hold and being embraced on the ground around Emerging Markets. In Africa M-Pesa, is an example of leapfrogging within the financial industry in EMs. It innovated its way into becoming the largest application in Kenya for payments, financing and banking services through a mobile phone-based system. Within two years of launch M-Pesa transfers amounted to 10% of Kenya’s GDP, now it accounts for nearly half. There are as many M-Pesa kiosks in Kenya as there are cash machines. In China consumers spent $5.5 trillion through mobile payment platforms in 2016, about 50 times the amount in the U.S.

It’s a small step…with big potential implications…

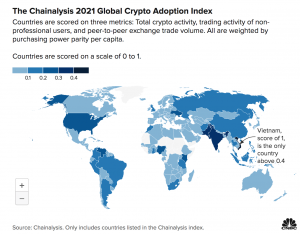

The leap from embracing FinTech to adopting DeFi and Crypto is a small one for billions of people in Emerging Markets looking for better financial services and to diversify their savings from often volatile local currencies and unstable banking systems.

According to the recently updated Chainalysis Global Crypto Adoption Index, global crypto adoption has taken off in the last year, up 881%, with Vietnam, India and Pakistan firmly in the lead.

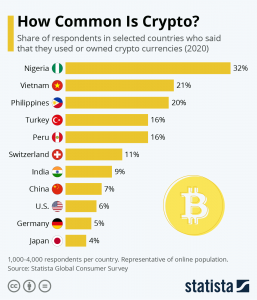

Binance has done their own report based on a Statista survey which, according to their metrics, revealed that Nigeria leads the world in the adoption of crypto in 2021, despite the federal government’s ban on the trading of digital assets in the country. Nigeria topped the list at 32 per cent, over Vietnam, the Philippines, Turkey and Peru. Amongst other key takeaways from the Statista survey was the fact that; “…with around 300 million users as of 2021, crypto is more ubiquitous than ever. That being said, there’s still plenty of room for crypto to grow and spread worldwide; despite the growing numbers, 300 million crypto users is only 4% of the world’s population.”

Emerging Market consumers are a key component to watch, and one ignored by most media reports. If you are looking to understand if crypto and DeFi will make the leap across the innovation chasm and find that ‘S-curve’ to mass-adoption you best keep your eyes on this key driver.

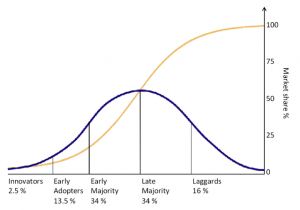

The technology adoption curve…Getting to that ‘S-curve’ is key…

Source: Binance

As we are fond of reminding everyone; It’s still early. While much of the data on EM adoption of crypto is very flimsy and lacking in historical depth, the direction of travel is becoming clear. Investors wanting to ‘skate to where the puck is going to be’ may want to take note and find pragmatic ways to participate in the wealth creation unleashed by the innovation underway at the edges of our global financial system.

“You never change things by fighting the existing reality. To change something, build a new model that makes the existing model obsolete.” – Buckminster Fuller